|

|

本帖最后由 I'm_zhcn 于 2009-6-8 16:23 编辑

Chasing After Crude in China? Just Log On

http://online.wsj.com/article/SB124441909805992625.html

JUNE 8, 2009 By CAROLYN CUI

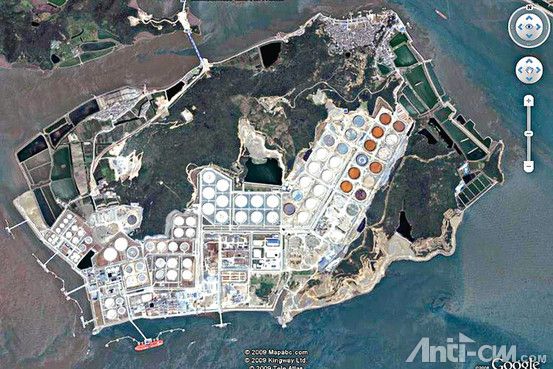

Google Earth's 2007 view of China's Aoshan Petroleum Reserve Google Earth

Oil analysts desperate for any insight into the murky world of China's economy are resorting to old-fashioned shoe-leather research, often with a high-tech twist.

Unraveling the mystery of Chinese demand, one big factor in oil's recent price spike, has become a full-time task for many oil analysts. Crude oil reached more than $70 a barrel on Friday for the first time since November, and analysts predict it could reach $80 by the end of this year.

While signs of life in the U.S. economy have helped drive some of the gains, analysts agree that peeking behind the curtain in China is the key to predicting oil prices.

China is estimated to account for 9.3% of the world's oil use, yet it releases no actual consumption data. That has led analysts to turn to Google Earth to track the movements of oil tankers and to travel across China meeting with low-level oil industry officials. To predict agricultural production, firms are studying ways to use satellite, weather and soil data throughout China.

These analysts were early in spotting a rise in demand in China this spring and believe demand will stay strong, justifying the current oil price and possibly pushing it higher.

Sanford C. Bernstein analysts Neil McMahon and Alexander Inkster are using Google Earth, the Web site that provides satellite images of almost any place on the planet, to zoom in on Chinese storage facilities, helping monitor the increase in capacity over time.

In May their focus was on Aoshan, a site in eastern China. Images from 2000, 2003 and 2007 proved what had long been suspected -- that storage capacity had been massively expanded. That helped give Messrs. McMahon and Inkster the confidence to predict a surge in Chinese demand.

"We look at very obscure things to understand oil's supply and demand," said Mr. McMahon. Still, he said he has no way to know whether the storage tanks will become full soon, despite some "unconfirmed reports" they had. "Who knows? China doesn't publish the inventories data," he said.

Chinese oil stockpiling "should have offered some support to crude prices, and will continue to do so going forward," the analysts said in a recent report.

"The findings have basically supported our view" on oil, Mr. McMahon said.

Sanford, a research subsidiary of asset manager AllianceBernstein L.P., forecasts oil will average $80 a barrel for 2010, more bullish than most.

Messrs. McMahon and Inkster are also using oil-tanker tracking data. They estimated crude tanker arrivals have increased by 400,000 barrels a day since last November, proving China is filling up that extra storage capacity.

There are limitations to these innovative methods. Google's satellite pictures are widely available and not updated frequently, raising questions about how much edge and precision the information can provide.

Historically, the focus of oil research was on the U.S. and Europe. Analysts would get a good handle of the overall picture just by looking at these two markets. The game changed in 2004, when Chinese oil demand surged 15.4%.

Paul Ting, a veteran energy analyst, left Wall Street three years ago and set up his own research firm, Paul Ting Energy Vision LLC, to focus on China. Mr. Ting, who speaks Mandarin, has used his ethnic Chinese roots to try to build a network of sources in China, including local companies, industry associations and semigovernment organizations, hoping to piece together information to get a more precise demand picture.

He spotted a sudden depletion of gasoline and diesel stores in April, signs of stronger auto sales and a pickup in industrial demand, and figured this would flow through into rising demand for crude oil in May.

Oil Movements, a U.K.-based consultancy, uses information from the oil-tanker market to provide a forward-looking picture of where oil supplies are headed. Founder Roy Mason says the firm's research spotted a spike in demand from East Asia in April by tracking oil tankers sailing to the region from Middle East and West Africa. The trend continued into June.

Lanworth, Inc., a Chicago-based agricultural information provider, is trying to replicate its success in charting corn and soybean crops through satellite images and combining the images with soil and weather data. "The interest level is very, very high," said Nicholas Kouchoukos, vice president of information services.

|

After, Chasing, google, try, 华尔街日报, After, Chasing, google, try, 华尔街日报, After, Chasing, google, try, 华尔街日报

评分

-

1

查看全部评分

-

|