|

|

本帖最后由 I'm_zhcn 于 2009-11-19 08:23 编辑

It's time to stop beating China up over its currency

http://blogs.telegraph.co.uk/finance/jeremywarner/100002038/never-mind-the-currency-domestic-demand-in-china-is-already-surging/

By Jeremy Warner Last updated: November 18th, 2009

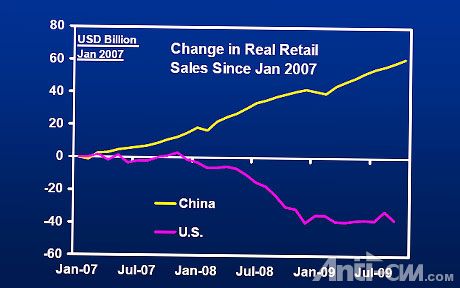

As US retail sales decline, China's are showing explosive growth

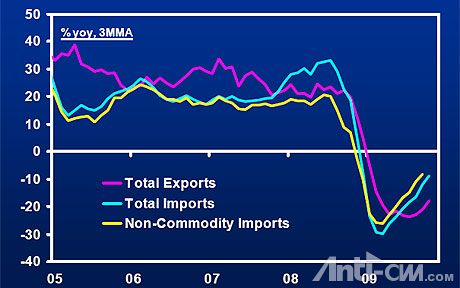

Imports into China are recovering much more strongly than exports

Maybe it’s just the contrarian in me, but the more the combined weight of the Western press unites against China’s stubbornly resistant approach to currency reform, the more sympathy I have for the Chinese point of view. The latest voice to join the chorus is the majesterial Martin Wolf, chief economic commentator for the Financial Times, whose musings on the wicked Chinese, Grim truths Obama should have told Hu in Beijing, can be read in this morning’s edition. Still leading from the front is old Kruggers (Paul Krugman, one time Nobel prize winner and now a columnist for the New York Times) who has been banging on about it again this week in an article headlined “World Out of Balance”. But you can read it almost anywhere.

Of course China must allow its currency to appreciate in the interests of a more balanced and sustainable world economy, and it will in its own good time. But it is perfectly reasonable for China to do so at its own pace, and in any case much of the present debate may be behind the curve in failing to appreciate just how sharply internal demand is already growing in China. Rightly Beijing dare not go faster. Take a look at the charts below, compiled by Goldman Sachs. Just as retail sales in the US have slumped over the last two years, they’ve grown like topsy in China.

Exports are indeed beginning to recover again, helped by the depreciating dollar, to which the yuan is still effectively pegged. But the much bigger story shown in the second chart is that imports are growing even more swiftly.

Sceptics will say this is just a temporary effect, which will wear off once the Chinese fiscal stimulus comes to an end, leaving China again dependent on an ever expanding current account surplus (or exports) to sustain growth. Maybe, but reports from the ground in China suggest that domestic demand, irrespective of the fiscal stimulus, has already reached takeoff point. Higher incomes and greater access to consumer credit promise to create self sustaining growth in the Chinese economy. But as long as uncertainty persists about what happens as the fiscal stimulus is removed, the Chinese leadership is understandably not wholeheartedly going to embrace currency reform.

And why should it? The west has enjoyed a free ride off the developing world for an awfully long time. Given the history, equalling things out a bit doesn’t seem such a crime. If the persistence for a little while longer of currency misalignment is one way of achieving this result, it doesn’t look so obviously bad thing. The “suffering” of America and Europe in this downturn is as nothing, believe me, to the grim reality of human existence in many developing countries. Obama says it’s all about jobs. Actually it’s about relative wealth, and within reason, it’s right there should be some redistribution.

Forget the credit crunch, this rebalancing of geo-political and economic power is the biggest story of our life time, and our childrens’ too. Currency reform must happen in time, but let it occur at a mutually agreeable pace. That requires a little give from the West.

|

beating, currency, Its, stop, 电讯报, beating, currency, Its, stop, 电讯报, beating, currency, Its, stop, 电讯报

|