|

|

本帖最后由 maxmin 于 2012-3-4 20:59 编辑

Home Prices Hit New Post-2006 Lows

By Dawn Kawamoto, The Motley Fool

Posted 3:35PM 02/29/12 Real Estate

Just when it looked like housing prices were bottoming out and now was the time to snap up the best bargains around comes news that may make you want to cool your heels. The latest updates on the S&P/Case-Shiller Home Price Indices were released on Tuesday, and they paint a picture of deteriorating prices that have continued to descend.

The S&P/Case-Shiller U.S. National Home Price Indexfell 4% in the fourth quarter, compared to the same period in 2010. Meanwhile, Case-Shiller's 10-City Composite was down 3.9% in December compared the previous year, while the 20-City Composite dropped 4%.

All three composites hit new post-housing-crisis lows. Moreover, the metropolitan city performance was worse than November, when the annual level for housing prices in both the 10-City and 20-City composites each fell 3.8%, according to the report.

David Blitzer, S&P Indices managing director and chairman of the Index Committee, provided the narrative behind the numbers in a statement: "After a prior three years of accelerated decline, the past two years has been a story of a housing market that is bottoming out but has not yet stabilized. Up until today's report we had believed the crisis lows for the composites were behind us, with the 10-City Composite originally hitting a low in April 2009 and the 20-City Composite in March 2011. Now it looks like neither was the case, as both hit new record lows in December 2011."

Search Millions of Home Listings

View photos of homes for sale and apartments for rent on AOL Real Estate

Economists point to an abundant supply of homes for sale and a large backlog of foreclosed homes as contributing to the declining prices. It's a simple case of supply and demand, and currently supply is bulging.

The National Composite, meanwhile, is down a whopping 33.8% from its peak in the second quarter of 2006, just before the housing crisis began.

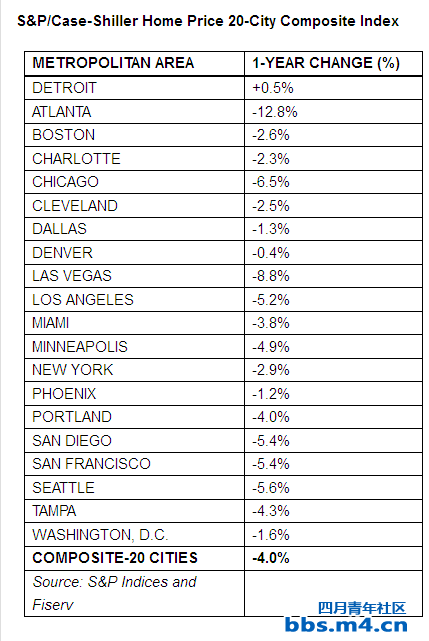

Among the 20 major metropolitan areas, Detroit was the only one to post a year-over-year gain in December. That strength was also seen in the Motor City's results in November. Atlanta, meanwhile, posted another double-digit decrease in housing prices and maintained its status as the nation's hardest-hit city based on its annual rate of decline.

Here's a look at how the nation's top 20 cities fared in December, compared to year-ago figures:

S&P/Case-Shiller Home Price 20-City Composite Index

Although sales of existing homes are on a rise, Blitzer and other economists warn it doesn't necessarily mean folks should expect home prices to follow.

Blitzer, in a previous interview with The Motley Fool, noted: "Home prices are usually one of the last things that improve. First, you'll usually see more foot traffic [with prospective buyers], then you'll see sales improve and then prices will begin to move up."

That last leg of prices moving up, however, may be awhile in coming.

|

|