|

|

http://money.cnn.com/2010/03/29/markets/thebuzz/index.htm

NEW YORK (CNNMoney.com) -- Google is to be commended for taking a stand against censorship in China.

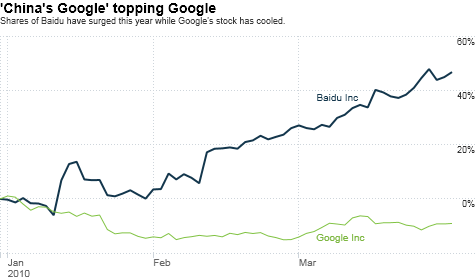

But investors are taking a stand of their own. They're selling Google and buying Baidu, also known as China's Google.

Shares of Baidu (BIDU), which already was the leader in online search in China before Google (GOOG, Fortune 500) began redirecting users of google.cn to its Hong Kong site last week, are up 4% in the past week and nearly 50% this year.

Google, by way of comparison, has missed out on this year's tech rally. It has fallen nearly 10% so far in 2010.

But is the run-up in Baidu overdone? And what about the sell-off in Google? Well, some think that both stocks are still a buy.

To start, the biggest mistake investors might be making is to think that Google has thrown in the towel on the world's most populous nation.

Morris Mark, president of Mark Asset Management, a New York-based hedge fund that owns shares of Google and Baidu, said that investors need to realize that Google still will be able to partake in the growth of online search in China.

"There is no question that people were looking at China as a major opportunity for Google and were disappointed," Mark said. "But this is important. Google has not left China. They've based the search servers in Hong Kong and China has not blocked the site."

For that reason, he thinks the recent dip in Google was an overreaction. He points to the fact that Google is still a market leader in the United States and most other areas around the globe. And despite that, the stock trades at only about 20 times earnings estimates for 2010.

As for Baidu, Mark conceded that the stock, valued at more than 60 times 2010 earnings estimates, is trading at a sizeable premium to Google. But he argues that Baidu is worth it considering its growth prospects. Analysts expect Baidu's profits to grow about 50% in 2010 and 2011.

Check out CNNMoney's new market pages

Steven Weinstein, an analyst with Pacific Crest Securities who follows Google and Baidu, agreed that investors shouldn't be playing an either/or game with the two stocks.

He pointed out that analysts' current growth estimates for Baidu don't factor in any benefit it may get from Google scaling back in China. So he thinks the recent move up for Baidu's stock is not an overreaction.

But at the same time, the fact that Baidu is beating Google in the Chinese search game doesn't mean that it's time to sell Google.

"Yes, China is a large and rapidly growing market. But there are 5 billion other people in the world in markets where Google dominates," Weinstein said. "There are other growth opportunities that Google has which people are discounting."

- The opinions expressed in this commentary are solely those of Paul R. La Monica.

|

buying, Buzz, google, Selling, The, buying, Buzz, google, Selling, The, buying, Buzz, google, Selling, The

评分

-

1

查看全部评分

-

|